When the time comes to renew your RCA insurance, few things feel as complicated as setting a fair, up-to-date, transparent cost that follows clear rules. This is exactly the clarity the Financial Supervisory Authority (ASF) tries to offer by publishing reference tariffs every semester. For 2025, the latest figures outline where prices are heading across the market, no matter if you live in downtown Bucharest, a provincial city, or the countryside.

How does the RCA reference tariff work?

The RCA reference tariff is an average calculated from historical claims data for different risk types (age, engine power, geographic area, etc.). It is not a fixed price for each driver, but it gives a fair picture of what can be considered “normal” for your profile.

ASF, as the national authority, publishes every six months a table with RCA reference tariffs for mandatory motor liability policies, using data collected from the entire market together with analyses from independent consultants. The regular update closely follows market dynamics, inflation, rising repair costs, and trends in claim frequency and severity.

Who sets the RCA reference tariffs and how often are they revised?

The decision and publication of RCA reference tariffs belong exclusively to ASF, which works with international consulting firms (KPMG, EY in previous years) using national aggregated statistics. Each semester brings an updated version aligned with the latest data and trends. This constant revision turns the tariff into a tool that adapts to economic realities, not just a formality.

This semi-annual cadence allows fast reactions to inflation, higher repair costs, or sudden legislative changes. Exceptions appear only when the Government steps in to cap tariffs temporarily for consumer protection, as happened in 2023, 2024, and 2025.

RCA price table: how the updated reference tariffs look by category

Category analysis confirms major gaps between Bucharest/Ilfov and the rest of the country, between young and experienced drivers, and between small and high-powered engines.

RCA price table 2026 for individuals

Drivers under 30: the highest auto insurance costs in 2026

The 2026 RCA tariff table shows a clear segmentation by age and engine output, with notable differences between Bucharest/Ilfov and the rest of Romania. For drivers under 30, costs are the highest on the market: for instance, for a car under 50 KW, someone from Bucharest or Ilfov pays 3,700 lei versus 2,152 lei in other counties. As engine power increases, prices climb fast—at 151-200 KW the same driver owes 5,029 lei in the capital compared with 4,089 lei elsewhere, and for engines above 300 KW the tariff hits 5,129 lei in Bucharest/Ilfov and 3,821 lei in other regions.

Drivers aged 31-40: more accessible RCA reference tariffs

Once you move into the 31-40 segment you benefit from milder RCA reference tariffs. A driver in this category with an engine under 50 KW pays 1,998 lei in Bucharest/Ilfov and just 1,200 lei in other counties. Engines between 76-100 KW cost 2,321 lei in the capital and 1,281 lei elsewhere, while engines over 300 KW drop to 3,667 lei in Bucharest/Ilfov and 2,140 lei in the rest of the country.

Drivers aged 41-50: experience brings advantages

Drivers between 41 and 50 enjoy even more advantageous tariffs. For engines below 50 KW, the premium is 2,013 lei in Bucharest/Ilfov and 1.194 lei in other counties. Engines between 101-125 KW cost 2,610 lei in the capital and 1,549 lei elsewhere, while 151-200 KW reaches 3,758 lei in Bucharest/Ilfov and 2,205 lei in the rest of the country.

Drivers aged 51-60: the lowest RCA tariffs

In the 51-60 age range, insurance becomes even more affordable. Engines under 50 KW cost 1,947 lei in Bucharest/Ilfov and 1,122 lei elsewhere, while 76-100 KW costs 2,061 lei in the capital and 1,242 lei in other regions. Even large engines between 201-300 KW stay under 3,600 lei in Bucharest/Ilfov and just above 2,000 lei in the rest of the country.

Drivers over 60: stable and advantageous RCA tariffs

For drivers over 60, 2026 RCA tariffs stay accessible and balanced, without major differences between Bucharest/Ilfov and the rest of the country. For engines under 50 KW the premium is 1,979 lei in the capital and 1,194 lei in other counties. Engines between 76-100 KW cost 2,410 lei in Bucharest/Ilfov and 1,500 lei across the rest of Romania, while more powerful engines above 200 KW are priced at 4,310 lei in the capital and 2,504 lei in other regions. Overall, this age group enjoys consistent, predictable pricing that reflects the experience gathered in traffic and the moderate risk level for this segment.

RCA price table 2026 for legal entities

RCA for legal entities: tariffs tailored to each vehicle type

For legal entities, 2026 RCA reference tariffs vary by engine output and registration area, with consistently higher values in Bucharest/Ilfov than elsewhere. Passenger cars up to 50 KW cost 1,981 lei in Bucharest/Ilfov and 1,364 lei in other counties. In the 51–75 KW range the tariff rises to 2,268 lei in the capital and 1,562 lei outside it, while 76–100 KW costs 2,005 lei in B/IF and 1,347 lei nationally. As engine power climbs, so do premiums: between 151–200 KW the tariff reaches 2,609 lei in Bucharest/Ilfov and 1,672 lei elsewhere, while engines over 300 KW cost 2,571 lei in the capital and 1,780 lei nationwide. These tariffs highlight clear gaps between regions and show how strongly engine power influences the final RCA cost for companies.

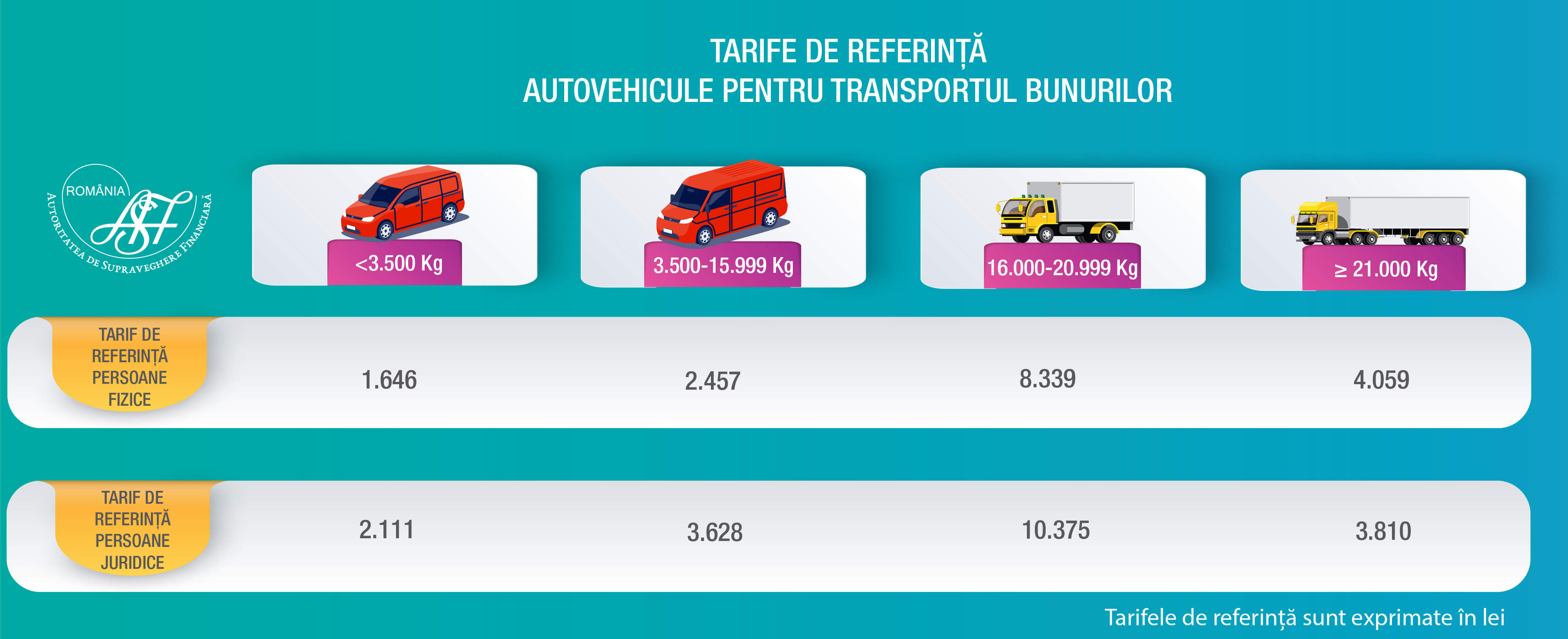

RCA price table 2026 for goods-transport vehicles

Goods transport: tariffs differentiated by vehicle weight

The 2026 RCA reference tariffs for goods-transport vehicles vary significantly depending on the vehicle’s total mass and the owner type—individual or company. Vehicles under 3,500 kg cost 1,646 lei for individuals and 2,111 lei for companies. In the 3,500–15,999 kg segment tariffs rise to 2,457 lei for individuals and 3,628 lei for legal entities. Differences balloon for heavy-duty vehicles: between 16,000 and 20,999 kg premiums reach 8,339 lei for individuals and 10,375 lei for firms. For the largest vehicles above 21,000 kg the tariff drops to 4,059 lei for individuals and 3,810 lei for companies, showing a tariff structure that differentiates clearly by segment and risk level.

Which factors influence these auto insurance price differences?

The main criteria in this RCA price table that determine pricing tiers are:

- Driver age: statistically, young drivers cause more accidents with larger losses, so risk is higher.

- Engine power: the more powerful the car, the higher the potential accident costs.

- Geographic area: urban traffic brings congestion and more frequent crashes, reflected in the price.

- Bonus-malus history: drivers without incidents receive meaningful discounts.

Why does the reference tariff in the 2026 RCA table matter?

An RCA price table published by ASF is not just a statistical benchmark—it is also a transparency and consumer-protection tool. If you gather at least three commercial offers that exceed this tariff for your risk profile, you have the right to request a reference-level offer through BAAR (the Romanian Motor Insurers Bureau). This prevents abuse or overpricing of so-called “problematic” categories by certain insurers.

Beyond that, the existence of this benchmark lowers negotiation pressure and avoids unpleasant surprises. All market players (customers, brokers, insurers) must operate within a predictable, fair framework. If you want to know exactly how to apply to BAAR for an RCA offer in a high-risk situation, read the full guide here: How to apply to BAAR for an RCA offer.

How to extract the correct value for yourself

You can quickly determine your correct price using the reference-tariff calculator above, which accesses the latest ASF tariff in real time. Without entering personal identification data you can obtain an accurate estimate for your combination of age, geographic area, and vehicle specs.

The essential step is knowing your KW and RCA bonus-malus class (if you already have a history). In just a few seconds the system returns both the market average and the relevant benchmarks from the ASF table.

Main benefits of consulting the online reference table:

- Make an informed decision before buying a policy from a broker or insurer.

- Protection against overpriced offers and confidence you are getting the best rate.

- Guaranteed access to insurance even if you are classified as “high risk.”

- Simplicity and speed: no need to fill out sensitive personal data.

How is an RCA reference tariff calculated?

How exactly are the high-risk premium and the recommended premium calculated?

On troco.ro the process of obtaining RCA offers is completely transparent and automated. After you enter your data and generate offers, the platform automatically checks whether you fall into the high-risk category. If all three offers received over 12 months from different insurers exceed the legal threshold (reference tariff × factor N × bonus-malus coefficient), you immediately receive a message that you can apply for the allocation of an RCA insurer via BAAR. That means no more manually checking conditions or doing your own math—troco.ro instantly shows the reference tariff for your profile. To qualify as high risk you must meet all of the following:

- You received at least three valid RCA offers from different insurers for a 12-month period.

- The offers include only the net premium plus distribution expenses for the sales channel, with no direct-settlement service or other extra clauses.

- All three total premiums, at the offer date, exceed: the reference tariff for the vehicle × factor N × the bonus-malus coefficient.

Calculation example:

- Vehicle: passenger car, 74 KW

- Owner: individual, 45 years old, residing in Bucharest

- Bonus-malus class: B4 (80% adjustment coefficient)

- Offers received: 2,280 lei, 2,350 lei, 2,400 lei

- ASF reference tariff: 2,022 lei

- Factor N: 1.36

High-risk premium calculation:

2,022 lei × 1.36 × 80% = 2,200 lei

If every offer you received is above this value, you are classified as high risk and can request insurer allocation through BAAR directly from the platform.

IMPORTANT:

You can request RCA allocation from BAAR only if all three 12-month offers are at least 36% higher than the reference tariff for your risk segment. This increase is compared with the ASF-published reference tariff, not the premium you previously paid.

Recommended premium calculation (for requests registered after 01.07.2025):

Pr = {TR × N + [(PO1 + PO2 + PO3) : 3] × 64%} : 2

where:

- Pr = recommended premium

- TR = reference tariff adjusted with the bonus-malus coefficient

- N = factor N

- PO1, PO2, PO3 = the three smallest net premiums among the offers

For requests submitted up to 30.06.2025 for goods vehicles above 16 tons:

Pr = (TR × N + Pmo × 39%) : 2

where:

- Pr = recommended premium

- TR = reference tariff for legal entities adjusted with the bonus-malus coefficient

- N = factor N

- Pmo = 18,548 lei (average RCA net premium for high-risk cases handled by BAAR in December 2023, adjusted for the new reference tariffs)

Notes:

- The recommended premium is calculated only for 12-month policies.

- BAAR does not set other contractual elements (terms under 12 months, installment payments, extra coverages, etc.).

- The RCA insurer is allocated within 20 days of submitting the complete request.

BAAR does not issue policies and is not an intermediary. Its role is solely to allocate an RCA insurer for high-risk customers. For other needs (terms under 12 months, installments, additional clauses) you must contact insurers or intermediaries directly.

Factors that update RCA tariffs

Semiannual changes are driven by:

- General inflation and inflation in the auto repair sector

- New costs for spare parts or labor

- Increases or drops in accident counts

- The introduction or expansion of categories (e.g., ridesharing drivers)

- New regulations such as temporary tariff caps

- Shocks caused by the collapse of major insurers

These factors act simultaneously: even if inflation pushes the reference tariff up, a year with fewer accidents can keep prices under control. Conversely, urban congestion and the growing number of powerful cars drive premiums higher for certain categories.

Key trends for 2025-2026

- The reference level rose with 5-30% depending on the group, versus last year

- Young drivers and owners of cars with large engines are strongly affected

- The Bucharest-Ilfov region again has the highest reference premiums in the country

How does the reference tariff influence real market offers?

Most insurers align with this benchmark when building commercial offers. Typically the reference tariff acts as an upper limit—insurers rarely go far above it, and competition can even push prices below, especially for low-risk drivers.

At the same time, the reference tariff protects customers from unjustified price jumps and encourages fair competition based on actuarial calculations rather than marketing or temporary discounts.

How can a driver benefit from this system?

- Always compare at least three offers, using the RCA calculator on troco.ro

- Check whether the offer you received is below or above the reference level for your profile. On troco.ro the system analyses the offers automatically and alerts you immediately if you are classified as high risk so you know whether you can apply to BAAR for allocation.

- If you cannot find an offer below the reference level, contact BAAR directly to request a better offer. The full guide on how to do this is available here: How to apply to BAAR for an RCA offer.

Transparency and the recurring update of reference tariffs have made the market increasingly fair for drivers, not just for insurers.

What should we expect from RCA tariffs?

Even if RCA prices rise or fall, clearer rules and close ASF supervision help drivers manage costs more easily. Fast access to the reference tables, the ability to verify your classification, and the option to ask BAAR for a better offer make the market fairer and more stable for everyone.

While some segments—young drivers or owners of powerful cars—pay more, the transparency and periodic updates give drivers confidence they will always find a fair offer that fits their profile.